Why embrace a new framework for Peace Finance?

While there is significant existing guidance for principle-based frameworks in Peace Finance, as detailed in the extensive research documented in the Mapping Investment Guidance for Peace 2023 by Finance for Peace, these often lack a direct focus on broader peace outcomes. Typically underpinned by broad and sometimes vague definitions of “social impact”, these frameworks may not enable well-meaning investors to intentionally impact peace. The Peace Finance Impact Framework addresses this gap, offering a more targeted and heuristic approach to Peace Finance, complementing existing frameworks and laying a foundation for investors seeking to align with peace-oriented goals.

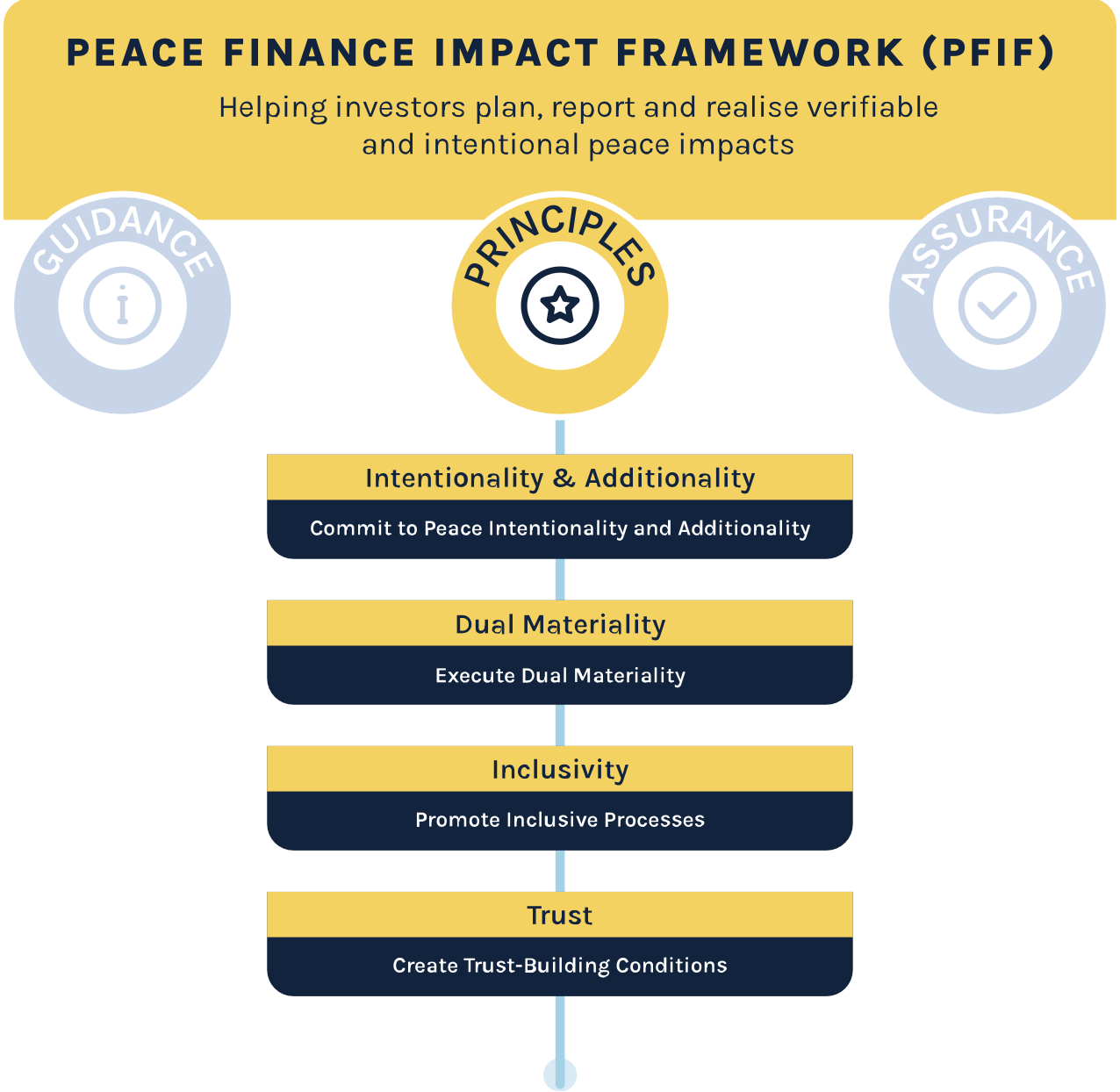

The four foundational principles of the PFIF

The PFIF introduces four principles, providing operational guidance for investors and issuers to make meaningful peace contributions:

- Commit to peace intentionality and additionality: This principle emphasises a deliberate commitment to peace-positive impacts. Investors should align their investments with the Peace Taxonomy, develop a theory of change and strategise with peace partners to ensure their investments genuinely contribute to peace.

- Execute dual materiality: This principle focuses on understanding and addressing both the risks and opportunities of investments in relation to people and the environment. It is about recognising the interconnectedness of business, environmental and community risks, especially in fragile markets.

- Promote inclusive processes: Inclusive processes are key to peace-positive impacts. Inclusivity requires ensuring that local communities are involved in investment design and that the outcomes are accessible and beneficial to them. It is about embracing local ownership and understanding the unique cultural and political dynamics of each context.

- Create trust-building conditions: Trust is crucial in Peace Finance. This principle advocates for cooperative, consultative and adaptive processes that prioritise transparency and stakeholder engagement. Building trust with local communities and stakeholders is essential to achieve successful, sustainable peace impacts.

The importance of these principles

These principles guide investors and issuers in creating impactful, peace-positive investments. PFIF users must align with these principles at both pre- and post-issuance stages of their investment, identifying and monitoring relevant indicators to demonstrate this alignment. That way, investments are not only financially viable but also contribute meaningfully to peace and stability in fragile contexts.